On the past few weeks we've had some events that shook the oil's market.

First, the Saudi Arabia Prince, Mohammad bin Salman said that his country was willing to keep the oil production low. This had an immediate effect on the markets, causing the oil prices to go up 2% on that day.

Second, the Iran-Iraq earthquake. They are, 5th and 4th biggest oil producers in the world, respectively. so anything major that happens in the region has a direct affect on the oil prices.

Apparently, the oil pipelines and refineries remained intact, but still, an earthquake that kills 500 people so far, has a direct impact on any country's economy.

Also, there is the Venezuela's default problem. Venezuela is the 11th biggest oil producer in the world, but the main thing about it, is that its biggest oil importer is the United States, the biggest oil market in the world. It's estimated that the oil transactions between the two countries moves around USD30 million/day.

And even worse: Venezuela has the biggest oil reserves in the world, and they are going through a major crisis right now, with the oil production levels falling each year. This limits their production, while the world demand keeps rising and, since oil is a limited resource, the prices tend to go up to compensate this. But this is thinking on the medium term and assuming that current conditions stay the same.

On our current pace and with the proven oil reserves we currently have, it is estimate that we only have 50 more years with this fuel. The following picture shows why:

Our production has been moving a lot faster than our discoveries. The bad news about this is that the more we produce, the cheaper oil tends to get. If oil is very cheap, why would someone want to creat alternative technologies to it?

Fortunately, to our world, this happened:

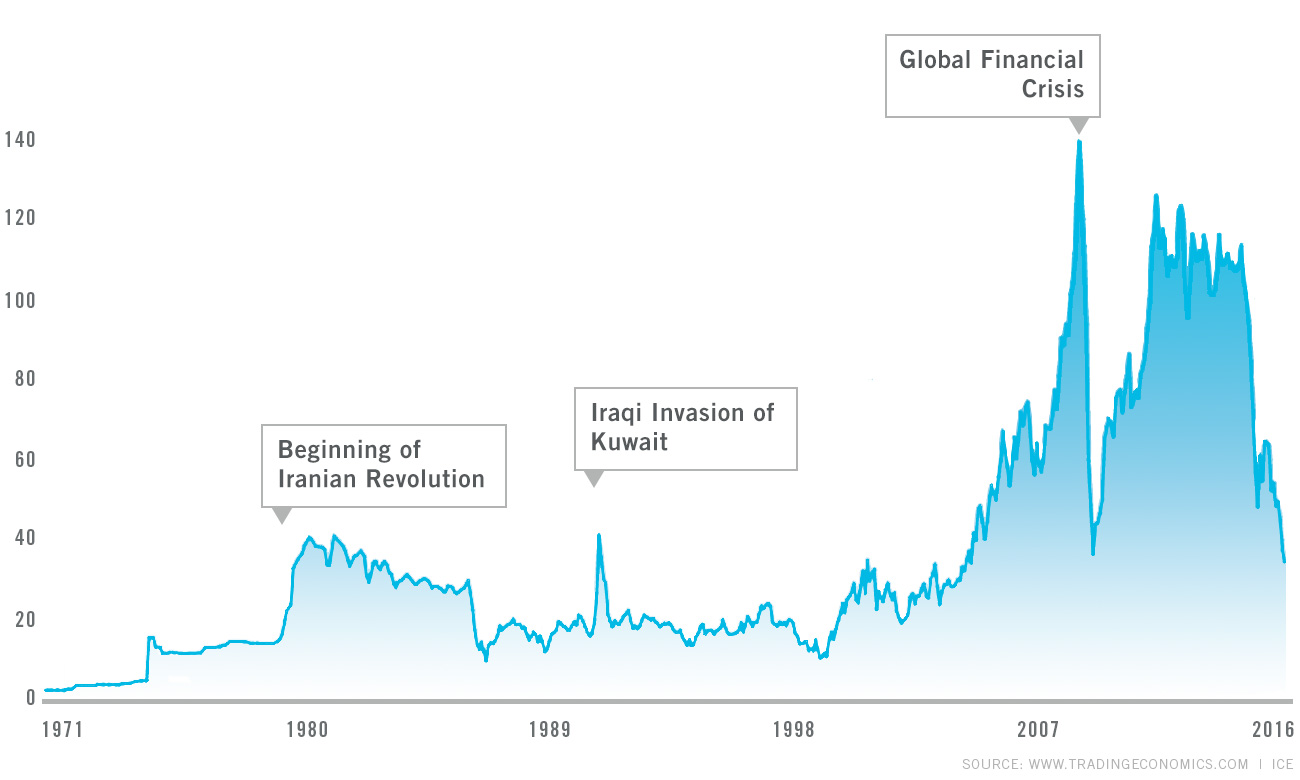

Oil prices reached a pike in the 2008 financial crisis, which led every country to start a search to alternative fuels.

This led to United States shale gas and to the Brazilian ethanol. But beyond, it boosted other technologies and made them competitive, such as wind and solar power, and it ended up boosting electric cars as well.

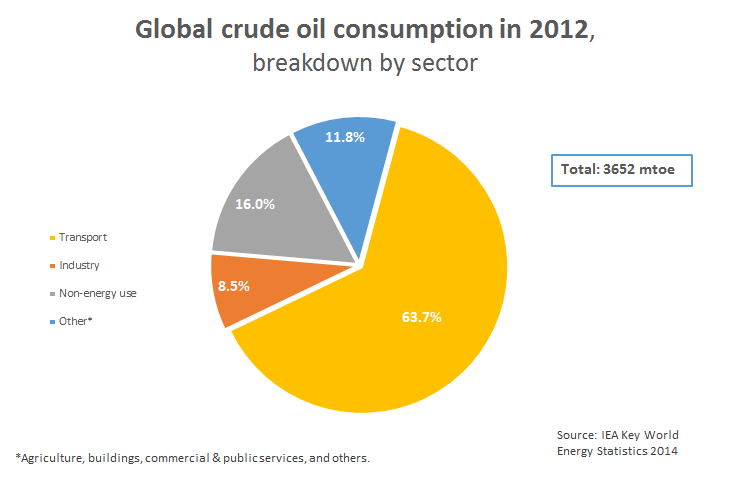

And i'm not talking only about Tesla, which is the big pioneer on this sector, but about the traditional car companies that saw that they needed to change their energy sources. This led to the engine's downsizing and to the creation of hybrid cars. All that helped reducing both emissions and consumption on the biggest oil consumption sector:

So, in the end, what's my call?

I think on the short term, the oil tends to go up, even with the WTI reaching something like 63 dollars.

But on the long run, with all new technologies that improve oil production and, at the same time, reduce its need, i think oil prices will begin to fall.

Nenhum comentário:

Postar um comentário